- Merge

- Posts

- Is Binance in Trouble?

Is Binance in Trouble?

Staying informed on the latest movements in the Cryptocurrency market.

Sunday is upon us.

So here’s your weekly breakdown of all the major things that happening in the crypto markets this week. Let’s get stuck in.

Biggest Gainers this Week:

Toncoin (TON) ↑38.54% |

THORChain (RUNE) ↑22.73% |

Maker (MKR) ↑13.63% |

Biggest Losers this Week:

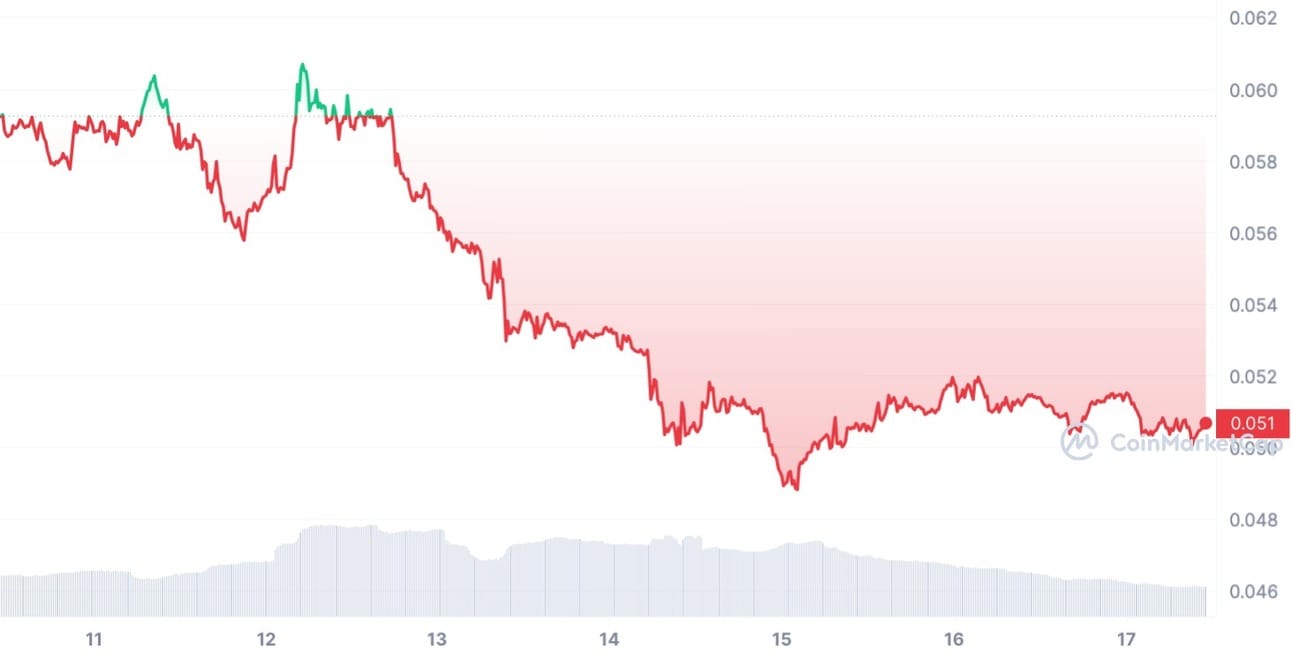

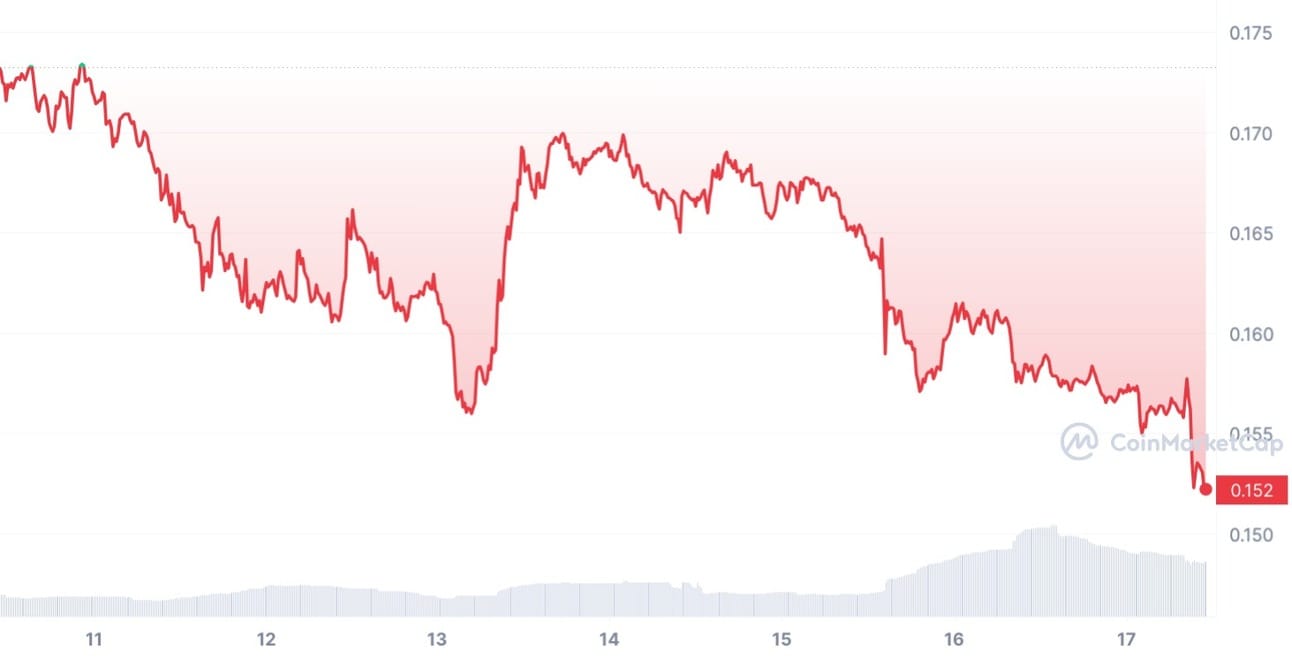

Astar(ASTR) ↓14.55% |

MIOTA (IOTA) ↓12.17% |

Flare (FLR) ↓11.92% |

This Week’s Roundup:

FTX to liquidate $3.4bn in assets

Coinbase launched BASE

Binance in trouble?

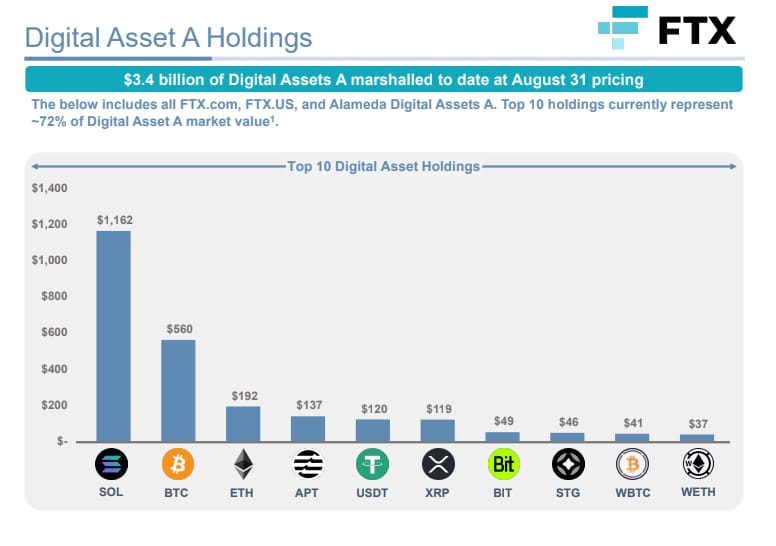

1. FTX is ordered to liquidate $3.4bn in assets

FTX, the cryptocurrency exchange which defrauded investors of billions of dollars has received permission from a U.S. court on September 13, 2023, to liquidate cryptocurrency assets.

This decision allows FTX to sell crypto assets and generate funds to repay its customers in U.S. dollars.

Why it's important to investors

Repayment Assurance: The court's approval of FTX's liquidation plan is significant for investors who had funds on the exchange. It provides assurance that FTX is taking steps to repay its customers.

Risk Mitigation: FTX's ability to enter hedging and staking agreements helps minimize the risks associated with the extreme price volatility often seen in the cryptocurrency markets. This can make the process of repaying customers more stable and predictable.

Market Impact: The decision reflects the complex relationship between a crypto exchange's actions and the broader crypto market. FTX's efforts to liquidate its holdings could potentially influence market prices, which is a critical consideration for cryptocurrency investors.

When it's happening

The court's approval for FTX to liquidate its cryptocurrency assets was granted on September 13, 2023. The exchange is now allowed to sell up to $100 million in crypto per week, with the possibility of increasing this pace to $200 million if both creditors' committees agree.

Important Note: There’s a lot of misinformation regarding the ‘huge sell-off of SOL over the coming months.

Much of the Solana holdings are staked well until 2028 before it can be unlocked. Be wary of the narratives that provoke feelings of FUD and want you to sell your tokens at these prices.

Want to read more? Check out thestreet’s article.

2. Coinbase has launched its own Ethereum-friendly network

Base is a cost-efficient scaling solution for the Ethereum network, offering completely secure and decentralised environments for developers to build Web3 apps.

Open-sourced and designed on the Optimism network, one of the most popular Layer 2 ETH blockchains - it offers Optimism rollups that take mainnet traffic to L2, cutting down transaction speed and cost of fees.

Base is open and Onchain Summer is here 🟡

Become a part of Base history by minting “Base Day One” to join the story of bringing the world onchain

Our story.

onchainsummer.xyz/base

— Base 🛡️ (@BuildOnBase)

5:02 PM • Aug 9, 2023

Why it's important to investors:

Expanded Functionality: With Base now open to users, individuals can perform various actions, including bridging tokens from the main net to Base, swapping tokens, providing liquidity on decentralized exchanges (DEXs), making payments, registering usernames, launching decentralized autonomous organizations (DAOs), and minting and collecting nonfungible tokens (NFTs).

Integration of Major Projects: The Base network has attracted several significant projects, such as Uniswap, Maverick Protocol, LeetSwap, Beam, Masa Finance, and Aragon, all of which offer diverse functionalities and opportunities for users. This level of project integration can potentially enhance the utility and appeal of the Base network.

NFT Opportunities: Base has partnered with multiple well-known brands and projects, allowing users to mint exclusive NFTs. These NFTs will be launched as part of the Onchain Summer Festival, potentially presenting investment and collecting opportunities for users and investors alike.

When is it happening:

The official launch of Coinbase's Base network occurred on August 9, 2023, marking its readiness for user adoption and engagement. The network had previously been in a phased launch, open initially only for developers.

Check out CoinTelegraph for more.

3. Binance in trouble?

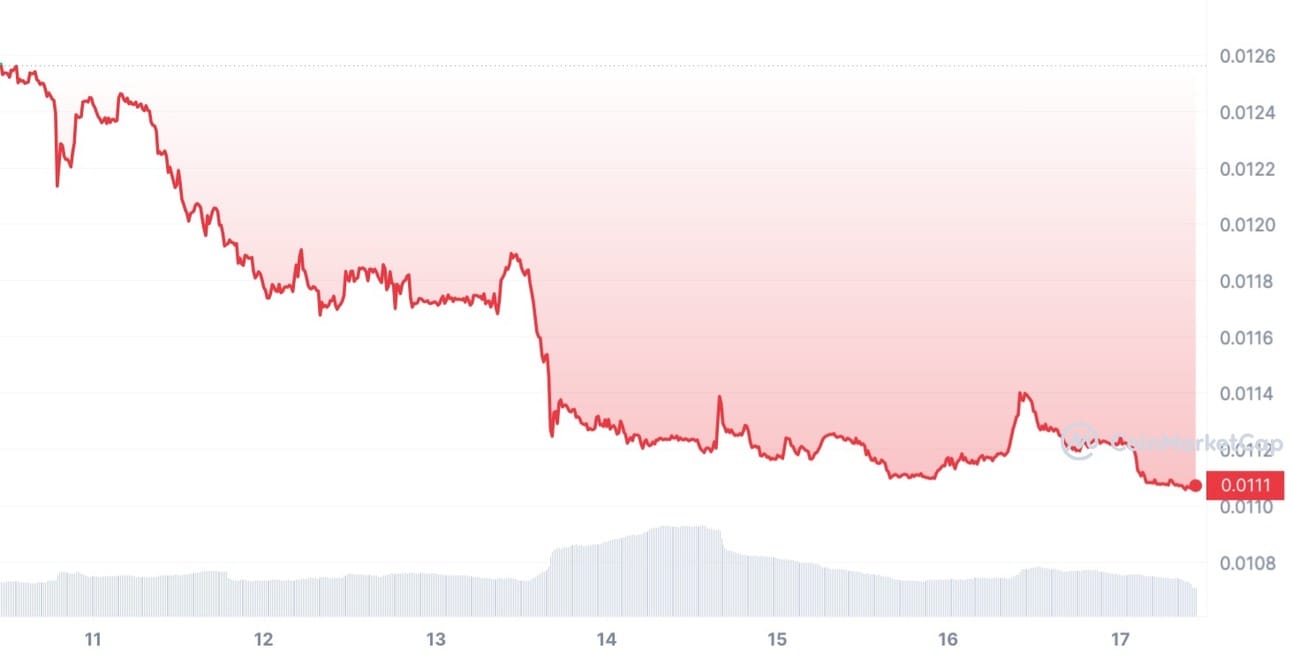

Binance.US, the US subsidiary of Binance.com, experienced a series of high-level executive departures over the last few weeks

CEO Brian Shroder resigned, followed by the departure of US's head of legal Krishna Juvvadi, and the chief risk officer Sidney Majalya.

Why it's important to investors:

Regulatory Pressure: The departure of top executives amid regulatory scrutiny is a significant concern. It suggests that Binance.US is facing intensified pressure from regulatory authorities, which can have implications for the exchange's operations and reputation.

Market Uncertainty: The resignations and regulatory challenges raise questions about the stability and future prospects of Binance.US. Investors may interpret these events as a sign of underlying issues within the exchange, potentially affecting market sentiment.

Potential Market Impact: Similar cases in the crypto industry, like the downfall of FTX, have shown that regulatory actions against major players can lead to market disruptions and asset devaluation. If regulatory actions against Binance.US escalate to the point of asset confiscation, it could have significant repercussions on the broader crypto market.

Lot of resignations from Binance lately, some black swan news coming? 👀

— FSTrades (@FSTrades)

5:20 PM • Sep 14, 2023

Check out Fxstreet for more.

These exits coincided with escalating regulatory pressure on Binance, including investigations by the US Securities and Exchange Commission (SEC) regarding alleged illegal operations in the US crypto market.

People are wary of the pitfalls of exchanges in light of FTX’s downfall last year.

If Binance, the biggest exchange in the world does fail (however unlikely), it would be potentially one of the worst things that could happen to the industry and could set it back years.

It could be the case it’s forced out of the US and becomes the hub for trading in Asia, whilst Coinbase and other exchanges take over its market share in the West.

Time will tell, but we’re optimistic that this is just a bump in the road.

Latest Industry News

Cuban suffered an $870,000 wallet hack, prompting him to transfer his remaining assets to Coinbase. The attacker targeted a dormant wallet that had been idle for nearly 160 days. Since then, Binance CEO Zhao urged the community to prioritise their crypto security.

Following in the footsteps of BlackRock and other financial heavyweights, Franklin Templeton has placed their bets on the fact that the SEC will soon allow a spot ETF to hit the public markets - potentially drawing in billions of dollars for clients who want exposure to BTC.

Vitalik’s Twitter account was hacked on September 9th, leading to a loss of nearly $700,000 worth of digital assets, including CryptoPunk NFT’s. What seemed like an authentic message which came from his account, was actually a typical ‘modus operandi’ - a deceitful link which allowed them access to the wallets of unsuspecting victims.

Market Movements

Total Market Cap:

Currently sitting at $1.03 Trillion as of today.

Bounced off the Key Fibonacci level of 0.382 ($1.157 Trillion) back at the end of July which is acting as support/resistance.

The next area of support appears to be just over the $1 Trillion mark, if we are to go down further.

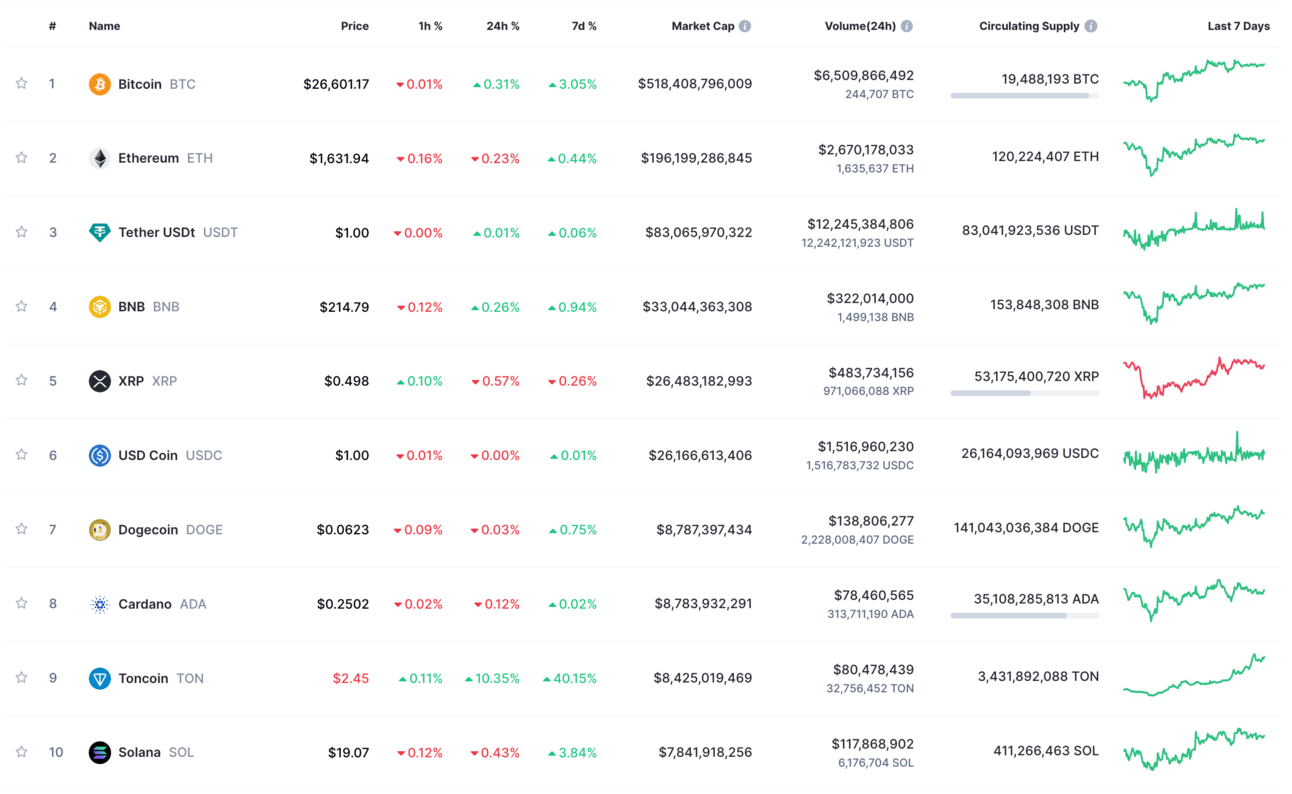

Top 10 Cryptocurrencies:

Bitcoin’s market cap is around $500 billion and Ethereum’s is just shy of $200 billion relatively unchanged compared to last week, with a small rise in both of their prices.

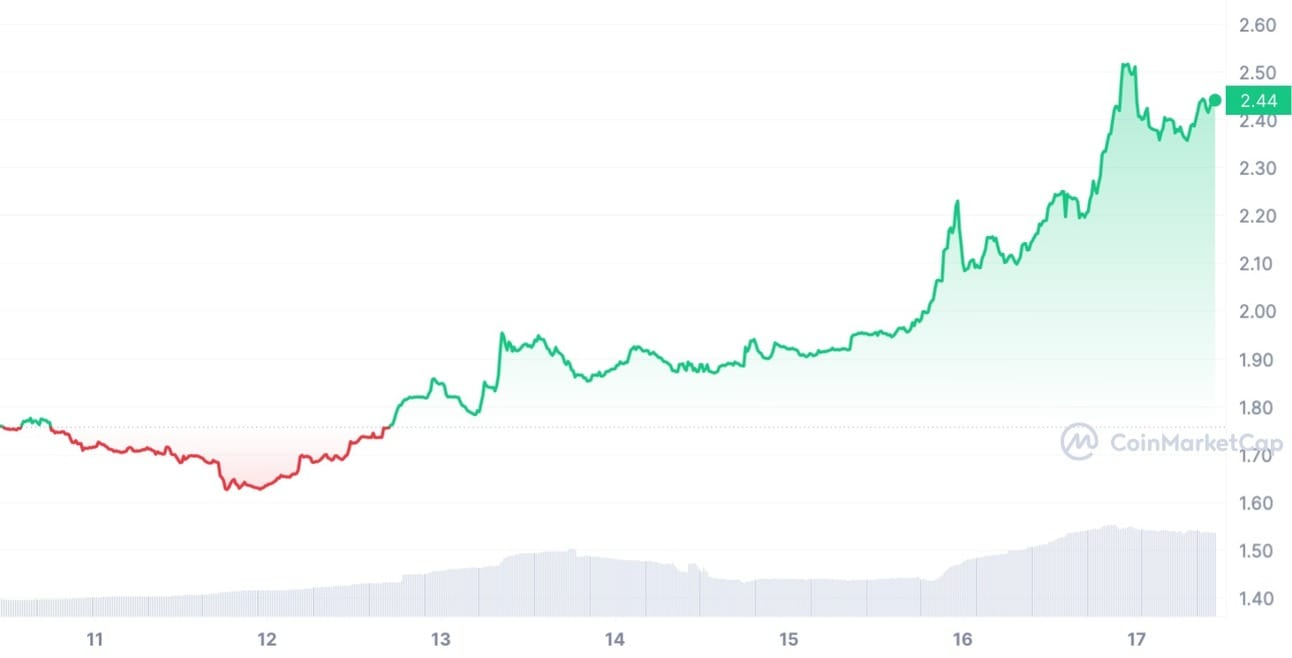

TON has climbed 40% in the last week, beating the likes of SOL and pushing TRX out of the top 10, a rise in line with their announcement of a partnership with Telegram.

As of 12:36 BST on 17/09/23

Key Indicators:

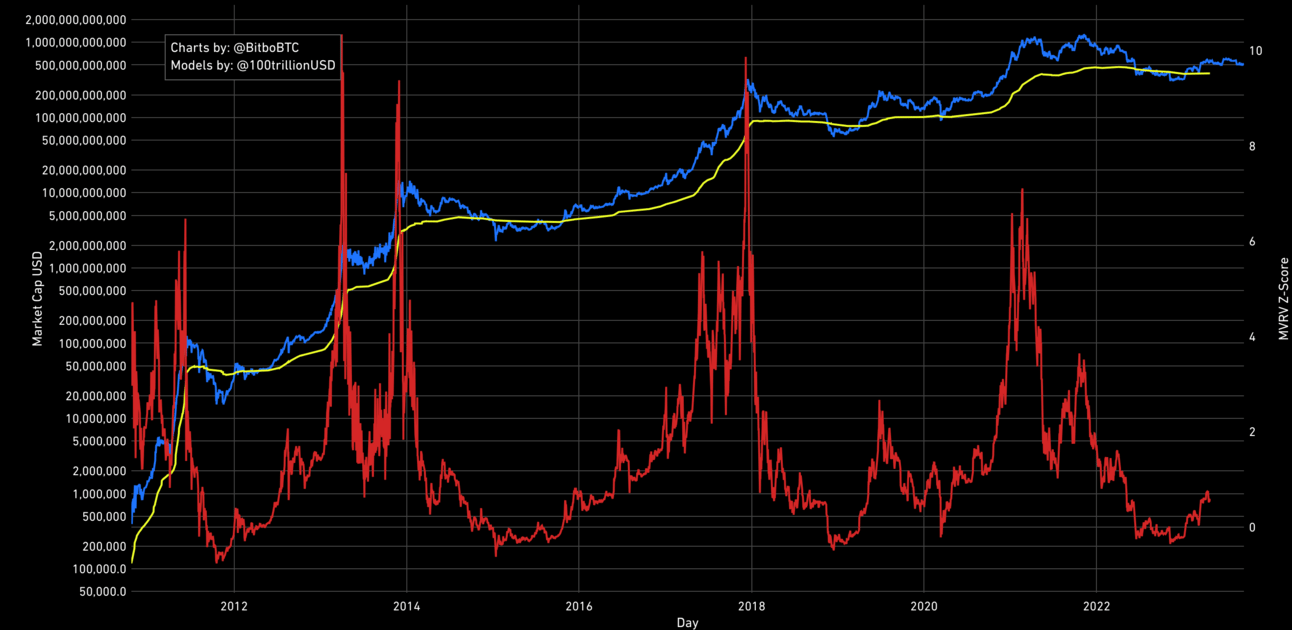

MVRV:

The MVRV Z-Score uses blockchain analysis to identify periods where bitcoin is significantly over or undervalued relative to its ‘fair value’.

It can be a good sign to an investor/trader of when to buy or sell. You can read more in detail about how it can be used here.

MVRV-Z Score Currently: 0.58

As of 12:36 on 17/09/23

TOP SIGNAL: MVRV>1 (3.5+) A higher number of larger unrealised profitability of BTC holders and subsequent selling might occur. | BOTTOM SIGNAL: MVRV<1 A lower number with fewer holders that are in a position of unrealised losses. |

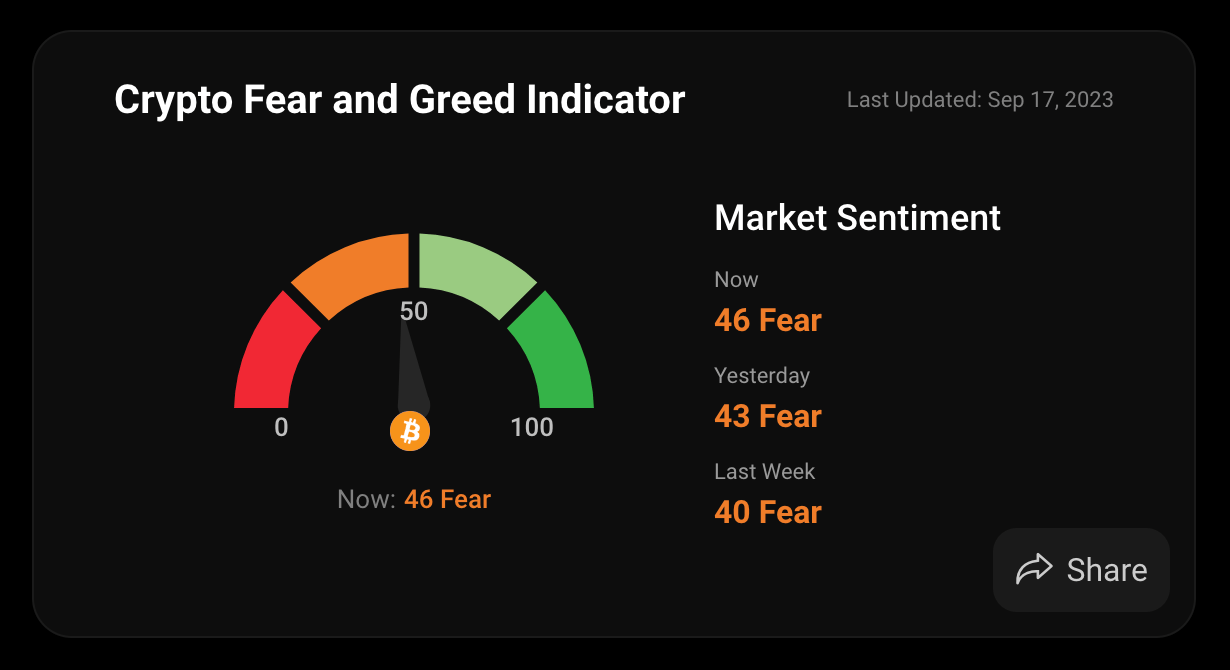

Fear and Greed:

Investors need to be cautious of their own nature as their emotions could cloud their rational decision-making and judgement.

This Index is a collection of sources to track the general sentiment of the crypto market.

Fear/Greed Indicator Currently: 46

As of 12:36 on 17/09/23

Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

When Investors are getting too greedy, that means the market is due for a correction.

Quote of the Week:

Be greedy when others are fearful, and be fearful when others are greedy.

Recommended Crypto Accounts to Check Out

That’s all from us this week, before we let you go here are some of our favourite Twitter pages for great content and deep dives on specific Crypto projects.

Shout us out if you find them valuable (we’re sure you will):

Just remember if you’re reading this, we’re so early in this journey of technology.

Zoom out, stick to your intuition and have patience - all great things come with time.

DISCLAIMER: This newsletter aims to be informative; it does not constitute investment or financial advice, or a solicitation to buy or sell any financial instruments. Neither is it a recommendation for managing your money. Be cautious and conduct your own studies anon, please.

Reply