- Merge

- Posts

- US Debt is Spiralling Out of Control 😵💫

US Debt is Spiralling Out of Control 😵💫

PLUS: We've got a new token added to our watchlist...

Sunday is upon us.

Welcome to another newsletter from us at The Merge.

This Week’s Roundup :

😵💫 US Debt is spiralling - and it’s only going to worsen

🚫 Blackrock Fund now holds over 50,000 Bitcoin

🚮 US Gov is selling $130M+ in seized BTC

Before we get into it, let’s take a look at the winners and losers of this week across the markets.

Read Time: 8 Minutes

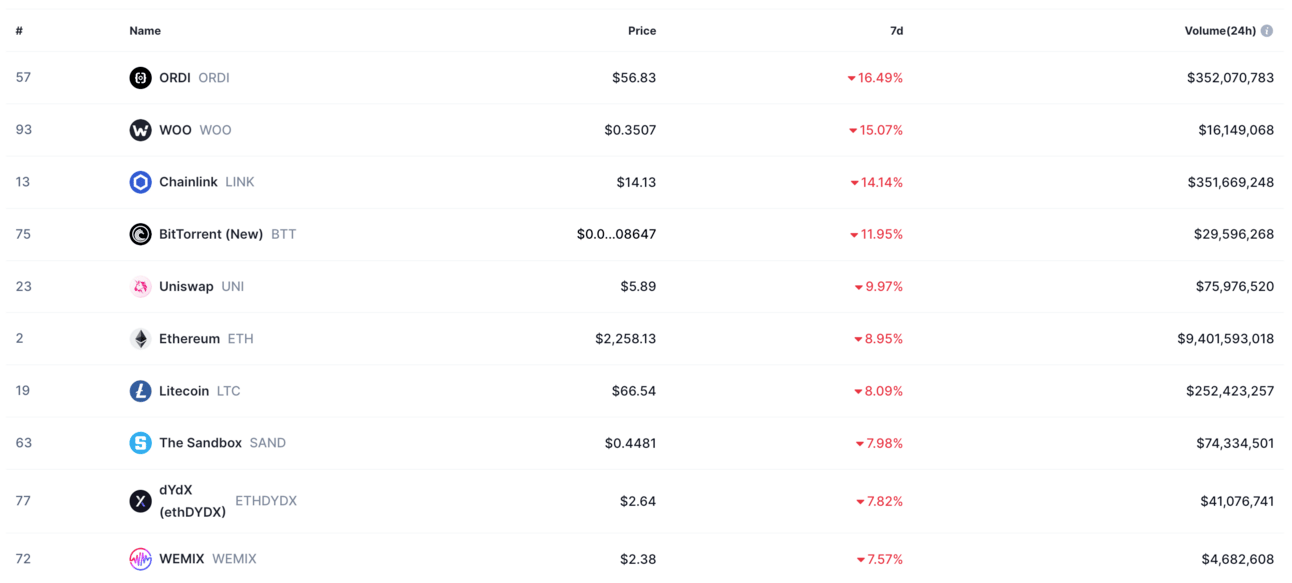

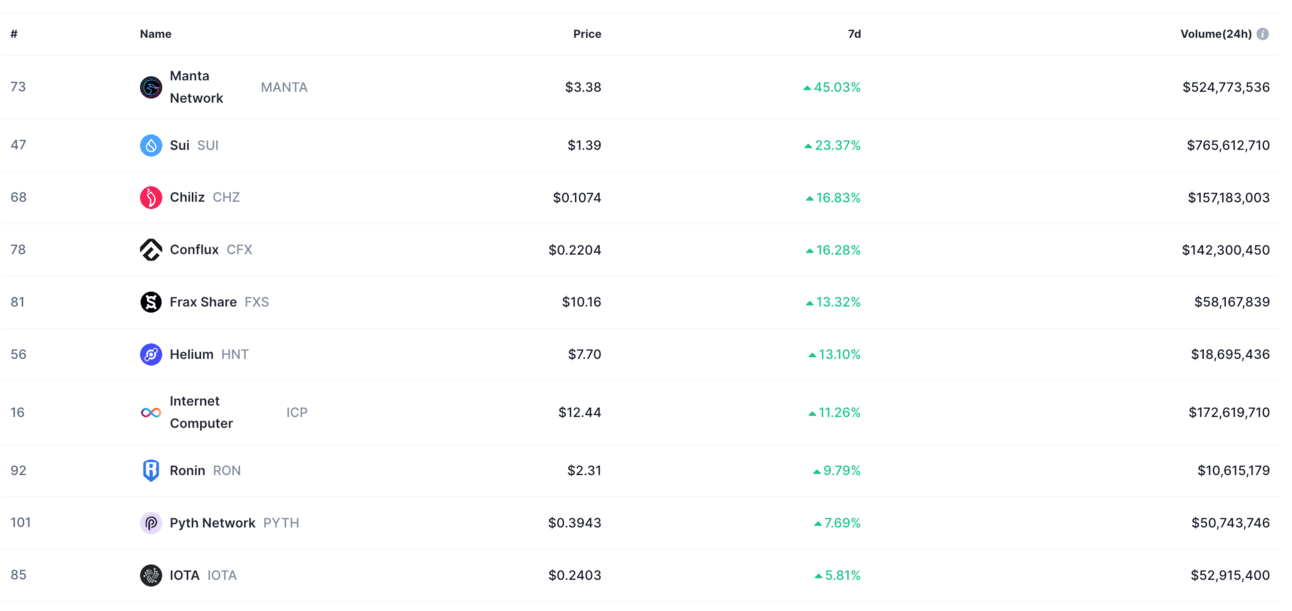

Biggest Winners & Losers This Week

Manta Network | MANTA - A newly released Ethereum Layer 2 (↑50%)

Sui Network | SUI - High-performance parallel EVM Layer 1 (↑23%)

Chilliz | CHZ - Entertainment and sports community token for fans (↑16%)

Ordinals | ORDI - Bitcoin NFT’s (↓16.49%)

Woo Network | WOO - High-performance centralised trading platform (↓15.07%)

Chainlink | LINK - Oracle allowing blockchains to connect to external data feeds (↓14.14%)

image from: Coinmarketcap

What’s happening in Crypto?

Here’s what else is happening in crypto that you should know about:

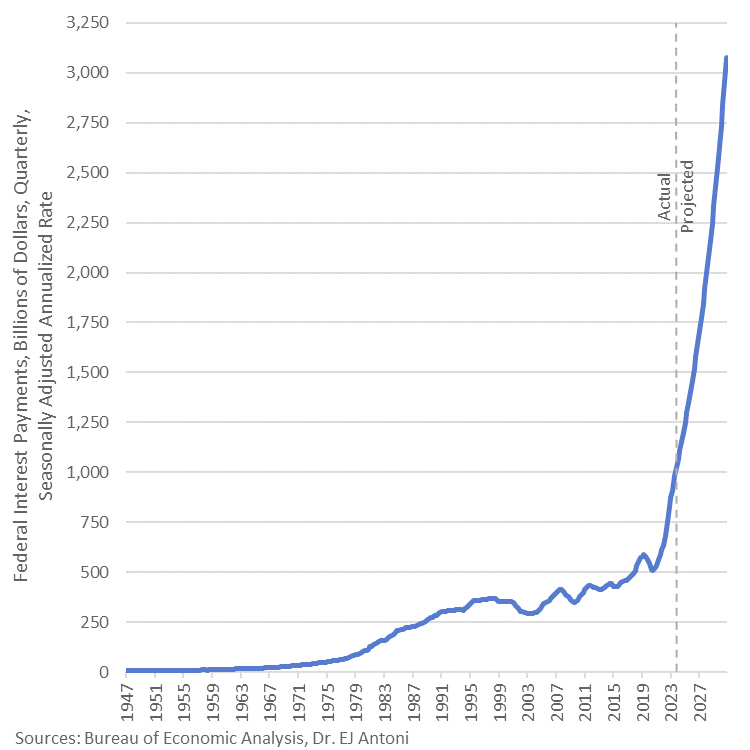

1/ US Debt is Spiralling - and it’s only going to worsen: An escalating annualised interest accompanies this steep climb on the federal debt that exceeds $1 trillion and is projected to break through the $3 trillion threshold by Q4 2030. Just take a look at the estimated projection below.

This is not good for the global economy in the long term. Guess there’s a reason why Larry Fink calls Bitcoin a ‘flight to safety’.

There’s no time like the present to start accumulating yourself.

E.J. Antoni, an economist at Heritage & Comm4Prosperity.

2/ BlackRock’s IBIT Fund holds over 50,000 Bitcoin

They have set a new benchmark in the cryptocurrency investment space by amassing over $2 billion in assets under management (AUM) just ten days after its trading debut, according to Bloomberg Terminal data.

image from:pionline.com

3/ US Gov is selling their Bitcoin

They recently filed a notice to sell $130 million of Bitcoin (BTC) previously seized connection with the Silk Road darknet marketplace.

There’s no time like the present to start accumulating yourself.

image from: coinstats.com

Our Favourite Tools to Navigate Crypto

👻 Phantom Wallet: Multi-Chain Crypto Wallet

Becoming our favourite wallet to use. An easy-to-navigate cross-chain compatible wallet (you can use it for SOL & ETH etc) with a user interface that beats most of the competition out of the ballpark (link)

😺🪐 Jupiter: Solana Decentralised Exchange

We only started using Jupiter a few months back and it’s by far our favourite DEX to use. Clean UX, cheap SOL fees, and DCA functionality are a godsend (link)

🦇 Arkham Insights: Smart Money Insights

An investment tool if you want to understand where ‘Smart Money’ (aka the market makers) are placing their bets then make sure to check it out (link)

🦙 DefiLlama: Defi Dashboard

Analytics dashboard which shows the Total Value Locked (TVL) across all of the major DeFI protocols (link)

🦎 CoinGecko: Crypto Data and Analysis Platform

Keep up to date with prices, trading volumes, and crucial crypto data (link)

Ones to Watch

This list will continue to grow/change as the month’s progress and the market develops over this coming bull run.

AI: (↑6.5%) this week

(TAO) Bittensor: 2.03B MC - Decentralised AI Network

(RNDR) Render Network: 1.46B MC - Decentralised GPUs

Gaming: (↑3.2%) this week

(BEAM) Beam Network: 876M MC - Network & Ecosystem for Developers and Gamers

(SFUND) Seedify Fund: 176M MC - IDO Launchpad for New Tokens

(SHRAP) Shrapnel: 57 MC - FPS Triple AAA Game Backed by Franklin Templeton (1.5B AUM)

Depin | Distributed Computing: (↑8%) this week

(SHDW) Shadow Network: 178M MC - Solana Infrastructure

(NOS) Nosana: $136M MC - Decentralised GPU's - NEW

(OPSEC) Opsec Network: 14M MC - Ethereum Privacy & AI Physical Infrastructure

L1’s/Parallel EVM: (↑4.75%) this week

(SEI) Sei Network: 1.54B MC - Extremely Fast L1 with V2 & Parallel EVM Launching in Q2

(NEON) Neon EVM: 94M MC - First Live Parallel EVM to go live on Mainnet - Direct Interoperability with No Fragmentation between ETH & SOL

(MONAD)* Coming this year → keep an eye out for it.

*NFA of course - these are just ones we’re keeping an eye on*

Key Indicators to Look at

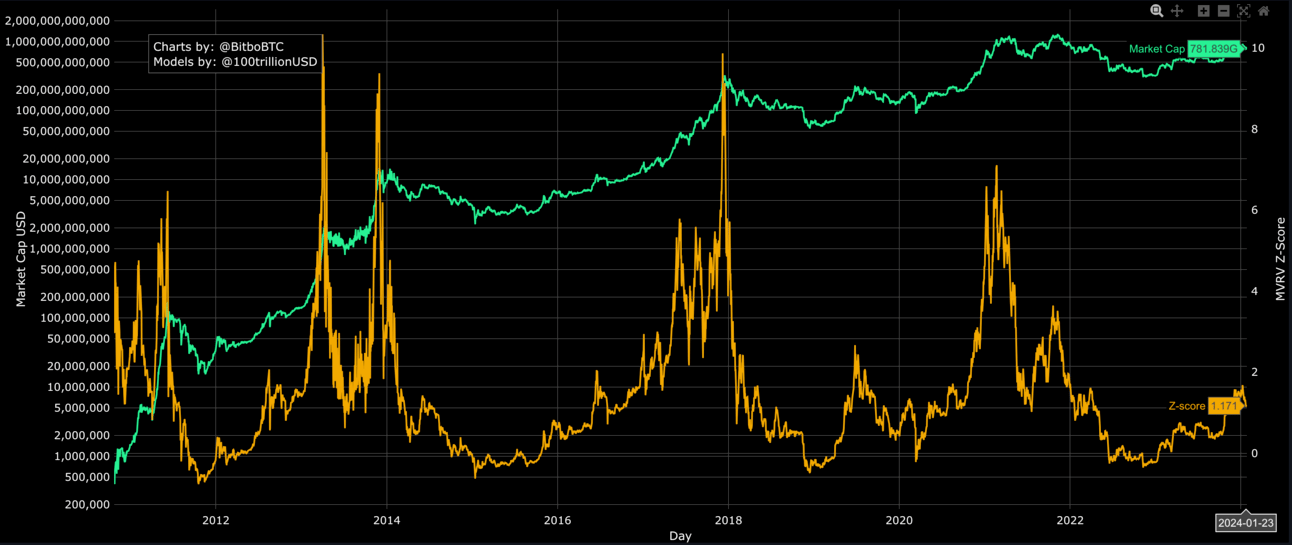

MVRV

The MVRV Z-Score uses blockchain analysis to identify periods where bitcoin is significantly over or undervalued relative to its ‘fair value’.

It can be a good sign to an investor/trader of when to buy or sell. You can read more in detail about how it can be used here.

Current MVRV Score: 1.17

As of 09:15 on 27/01/24

TOP SIGNAL: MVRV>1 (3.5+) A higher number of larger unrealised profitability of BTC holders and subsequent selling might occur. | BOTTOM SIGNAL: MVRV<1 A lower number with fewer holders that are in a position of unrealised losses. |

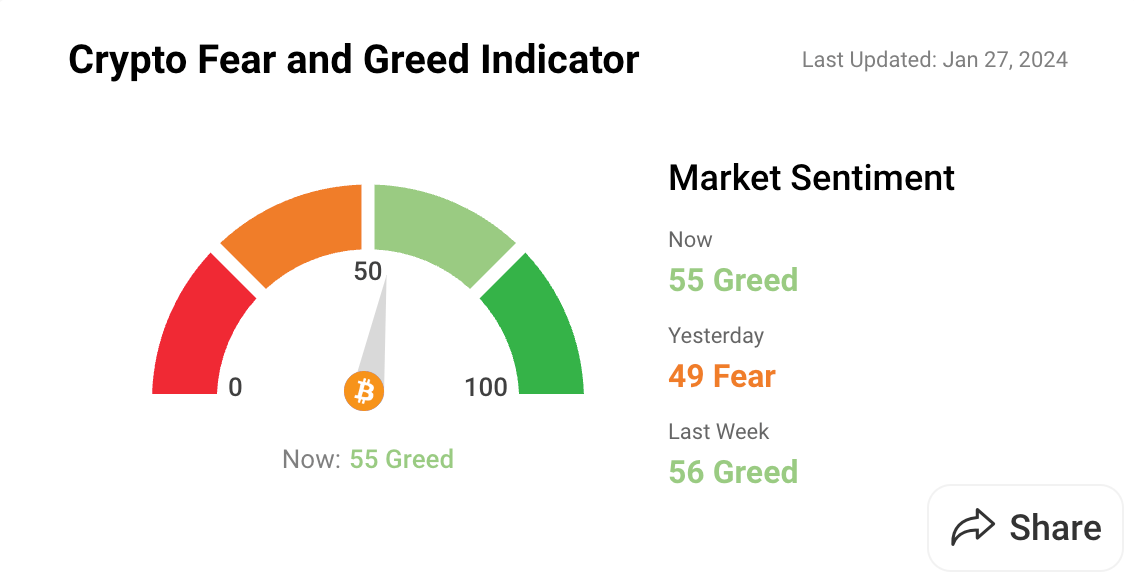

Fear and Greed

Investors need to be cautious of their own nature as their emotions could cloud their rational decision-making and judgement.

This Index is a collection of sources to track the general sentiment of the crypto market.

Current Fear & Greed Index: 55

As of 09:15 on 27/01/24

Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

When Investors are getting too greedy, that means the market is due for a correction.

That’s it!

As always, thanks for reading.

Hit reply and let us know what you found most helpful this week—we’d love to hear from you.

Until next Sunday,

The Merge

Reply